Rolex at Auction: An Index and Report on Rolex 'Professional' Watch Prices and Trends

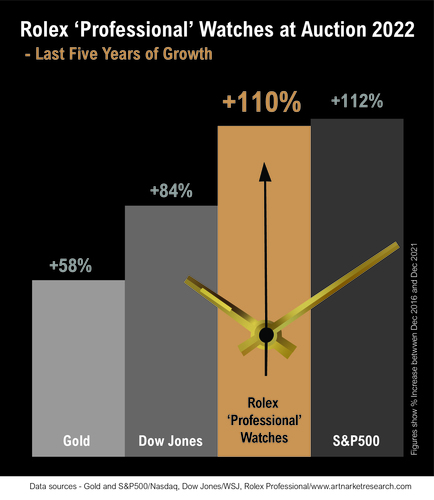

WORLD’S FIRST INDEX REVEALS ROLEX ‘PROFESSIONAL’ WATCHES OUTPERFORMING ALL OTHER PASSION INVESTMENTS.

NEW REPORT IDENTIFIES CURRENT TRENDS BEHIND PHENOMENAL GROWTH

09 June 2022: The world’s first index tracking the value of Rolex ‘Professional’ watches is being published in a new report by Art Market Research (AMR) today.

The Index is featured in AMR’s ‘Rolex at Auction’ Report, which takes a closer look at the hugely popular market for Rolex ‘Professional’ watches (including ‘Sports’ and ‘Tool’ watches), a sector doing so well, it outperformed all other alternative assets in 2021, including Art, Classic Cars and Coins.

AMR is an independent research company and uses price information – collated from auction houses located all around the world – to measure the performance of 22 Individual watches including Daytonas, Submariners, Explorers and others. AMR’s index methodology was devised in association with the London School of Economics.

Sebastian Duthy says, “Rolex ‘Professional’ watches have grown in value twice as fast as any other brand sector over the last 15 years and show no signs of slowing down.”

Remi Guillemin, head of Christie’s watch department in Geneva, contributes to the report and agrees that business in the Rolex market has never been so good, “There are so many people who are ready to invest in watches at any level that I think it’s unparalleled. And the fact that people see that watches sell well, it motivates people to sell their watches. Right now, we are in this situation where many stars are aligned.

Sebastian Duthy adds: “Rolex’ Daytona watches are no longer the only vintage styles in most collector’s sights. Certain Rolex Explorers, GMT-Masters and Submariners are increasingly popular, not least because starting at around a tenth of the value of many vintage Daytona’s, they are still within reach.”

James Marks is International Specialist at Phillips and an expert on Rolex watches. He shares his own thoughts on investment in the report, “When you are dealing with property that are both low volume, design icons and crucially transportable wealth, the notion of investment becomes highly attractive”.

Contrary to what many in the industry claim, the report finds that rarity is not the most important factor driving prices. Sebastian Duthy says, “Condition is key to ensuring a Rolex watch will grow in value and some of the references produced in much larger numbers have seen more examples survive in mint condition. In addition, higher volume of trading in these models is conducive to establishing market value, making these references more interesting to investors.”

As well as sharing the index, the Rolex at Auction Report takes a closer look at individual watches in demand, and finds that the sector is increasingly volatile. Sebastian Duthy says; “Collectors know precisely what they want and are hunting very specific pieces. For example, a gold Daytona 6263 is more sought after if it has a black dial, while black dials on a Ref.3525 are less in demand.

Highlights from Art Market Research’s Vintage Rolex Sports Watch Report include:

• 2021 was a record sale season as it was the first time 5 Rolex watches broke the million-dollar mark in a single year.

• The value of vintage sports watches made by Rolex have risen over 2000% since the 1980s. In 2021 average values rose 24%

• Value of a Rolex Explorer, considered the most underrated of all Rolex references, rises fastest in last 5 years.

• As Chinese mainland buyers increasingly eye the market, Hong Kong is quickly closing in on Geneva as the destination for top watches.

• Poly Auction in Hong Kong is the favoured auction house for mainland Chinese buyers. While total sales are a fraction Phillips, Sotheby’s and Christie’s, average prices paid for watches was the third highest of those surveyed.

• Despite the trend towards online-only sales, live sales remain critical to achieving high prices. Phillips are the only auction house who don’t see the need for online-only, as James Marks, international specialist explains, “Vintage watches need to be handled and understood in person to achieve the values that these pieces command.”

• Condition is increasingly important and AMR’s Index tracks only those watches in very good condition, eliminating poor or heavily restored examples. Sebastian Duthy says, “The prices between an average example and a top example will be in a different world. Unfortunately, the market now is much tougher than it used to be.”

• London’s auction market for watches is in a period of decline as auction houses shift focus to the Eurozone. With Sotheby’s inaugurating watch sales in Paris and Antiquorum’s first sale in Forte dei Marmi, Italy, in 2021, total sales at the Eurozone’s top auction houses were two-thirds higher than in London.

Millennials

Driving interest are millennial collectors with deep pockets, as James Marks explains: “Every month that passes more and more young and engaged collectors enter our market, thirsty for knowledge and the finest watches”.

Remi Guillemin at Christie’s also notes how the market is changing. “There are a lot of millennials who are coming to the market, so our clients are particularly young. People who have purchasing power and a thirst to learn. They travel throughout the world to attend auctions. If they are in the US, they will come to Geneva, Hong Kong, Japan, Dubai and the middle east and inspect every single Rolex in front of them.”

China

Poly Auction in Hong Kong has been selling watches since 2013. While the volume is comparatively small, prices achieved are some of the highest in the world. Karen Ng, is the auction house’s watch specialist and says she is seeing more and more interest from mainland China, “The Chinese watches market has grown significantly in recent years, with many valuable items being sold in the market. Our watches platform will be able to connect the international community with the growing interests in the Chinese market.”

The Data

Starting with a comprehensive study of the major auction house watch departments worldwide, the report compares the global market by size, price and geography plus an analysis of trends in Online-Only and Live sales.

With research on over 1,000 prices on 22 Rolex References since the 1980s, the index is an essential tool in navigating this rich and varied sector. The data is also broken down into a series of raw data charts plus individual case studies showing how AMR arrives at its conclusions.

The Report also explores the key auction events driving interest since 2002 and notes how auction houses continue to draw collectors. Remi Guillemin has overseen the modernization of Christie’s watch department in Geneva, “The auction market is a much more efficient market than it was before. So, with internet and social media, you are able to touch more people. We do still print catalogues but it’s more of a luxury!”

Telling more than just the time

From reading the Report, it is clear: the market for Rolex ‘Professional’ watches continues to evolve, becoming both more sophisticated and volatile. New, young collectors are committed to finding watches which will provide a return on investment and auctioneers are following the trend. As scholarship around Rolex sports watches grows worldwide, the market is set to continue to rise.

Sebastian Duthy sums up: “The report shows that while some dealers might have good instincts over the most investible Rolex watches, only studying the data will give you the true picture. Rolex is the most recognizable watch brand today and young collectors will travel far and wide to secure a handful of sought-after references.”

The Rolex ‘Professional’ Watch Report is available to purchase from https://www.artmarketresearch.com at £295.00 plus VAT.

Ends

For more information:

Sebastian Duthy

Art Market Research

s.duthy@artmarketresearch.com

07968 481 395

Note to Editors:

a) Art Market Research (AMR)

This is a new addition to AMR indexes that are used as benchmarks for comparing price trends of alternative assets and passion investments. AMR database contains over 1.7 million prices of works by more than 20,000 artists working in Painting, Sculpture, Prints and Photography and holds over two million transactions on Classic Cars, Jewellery, Watches, Handbags, Stamps, Coins, Ceramics, Books, Furniture and Silver. AMR has been providing independent art market analysis since 1978.