Recent findings from The Clifton Private Finance Mortgage Pulse Report 2024 shed light on the UK population's perceived ability to keep up with their mortgage repayments in 2024, as many come off low fixed rates onto new, significantly higher rate deals.

The data, collected from more than 350 form submissions on the Clifton Private Finance website between November and January, reveals some important findings that reflect the broader UK economy and public sentiment towards interest rates, inflation and the current cost of living.

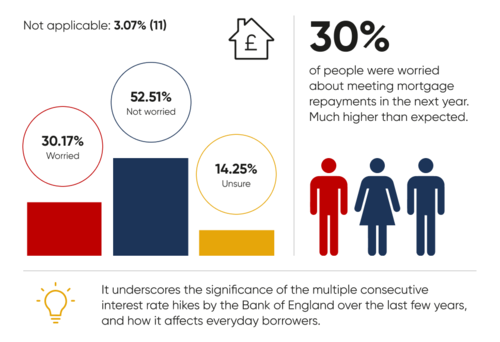

Key highlights from the report indicate that 1 in 3 are worried about keeping up with their mortgage payments in 2024.

It underscores the significance of the multiple consecutive interest rate hikes by the Bank of England over the last few years, and how it affects everyday homeowners.

Clifton Private Finance’s mortgage brokerage experts have also offered their perspectives on the survey results,...