The £4bn Dilemma – Refurbish the Houses of Parliament or Provide 1 in 3 Homeless People with a New Home?

Research has revealed matching the cost of planned Palace of Westminster repairs could dramatically reduce the UK housing deficit.

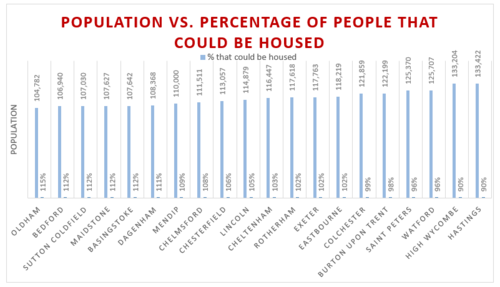

Data examined by property finance specialists Pure Commercial Finance revealed for £4bn – the estimated cost of essential repairs in Westminster – over 40,000 new properties could be built, housing almost 121,000 people (three people/property).

Government figures reveal 430,000 affordable homes have been built since 2010, but housing charity Shelter estimates a deficit of 3.2m homes and states there are around 320,000 homeless people in the UK – 170,000 in London alone.

Using internal data, Pure Commercial Finance calculated that the average 3-bedroom home in the UK costs £99,842.75 to build, meaning the Houses of Parliament budget, if matched, could house over a third of the UK’s rough sleepers (37.5%), or 71% of the capital’s homeless.

Ben Lloyd, Managing Director and Co-founder of Pure Commercial Finance, said:

“As development finance specialists, we deal with professional developers every day and are well-aware of the demand for affordable housing across the UK and the influence Brexit is having on borrowing.

“Although we would never suggest cancelling the refurbishment of such a prized national monument, we were shocked to see how matching the refurbishment budget could help towards solving the deficit.

“We placed millions of pounds of commercial property finance last year and will continue to ease the affordability and process of building across the UK for the foreseeable.”

Polly Neate, CEO of Shelter, stated:

“It’s unforgivable that 320,000 people in Britain have been swept up by the housing crisis and now have no place to call home. These new figures show that homelessness is having a devastating impact on the lives of people right across the country.”

To view the full research, visit this page, or if you'd like the full list of cities and towns by percentage, please get in touch:

https://www.purecommercialfinance.co.uk/news/could-redistrib...

-Ends -

*Methodology

Pure Commercial Finance conducted research into the average cost to build a standard size home. This figure was calculated by working out the average cost per square foot to build a home for Pure Commercial Finance clients; £112.50, this excludes the cost of purchasing land. This was then multiplied by the sq ft of workable floor space of the average 2/3 bed small-large terraced house popular with first time buyers. This gave us a figure of £99,843.75. Based on the Houses of Parliament refurbishment cost of £4 billion, this would produce 40,062 homes, should the funds be reinvested or matched.

Based on public research, there are estimated to be 320,000 homeless people in the UK. Provided three people are housed in each new home built, this would close the homeless gap by 37.5%.

About Pure Commercial Finance

Pure Commercial Finance is a specialist finance brokerage that sources and arranges funding for a range of uses, including property development, bridging, and buy-to-let.

Pure helps property investors, developers and business owners find the right deal for their project and work with them to ensure long-term success. They also make sure that the deals introduced to lenders fit their criteria and help them meet their lending goals.

Working with over 100 lenders this year, Pure has completed transactions worth over £250m, ranging from simple commercial property purchases to multi-purpose ground-up developments.

As a company, Pure prides itself on ensuring two simple principles: maintaining a reputation for excellent service and achieving outstanding results for clients. Something that has been awarded by achieving Best Development Broker at the Bridging & Commercial Awards and Best Development Finance Broker at the SFI Awards.

For more information about Pure, or for further quotes, please contact Emma Hull at emma@libertymarketing.co.uk