Baby Boomers May Be Putting Their Family's Inheritance At Risk

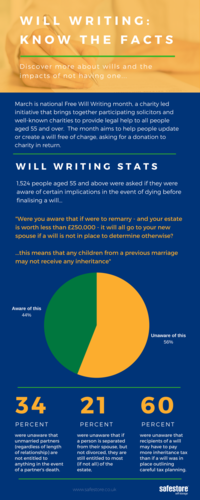

Borehamwood, Hertfordshire - March 13, 2017 - Research carried out by Safestore has revealed that 31% of people aged 55 and over do not have a will and as a result, may be risking inheritance for future generations . Inspired by Free Will Writing month which takes place throughout March, the self storage company discovered that an alarming number of Baby Boomers may be putting their family's inheritance at risk for all the wrong reasons.

Out of 31% of adults aged 55 and over who do not have a will:

- 12% have children in their household

- 16% are separated or divorced

- 48% admit they 'haven't got round' to writing one

- 18% feel that they don't have anything of value to leave behind

- 12% believe that all assets would go to a partner regardless

"Wills are essential life documents which really ought to be in place well before you reach 55. It is concerning that so many 55+ year olds have not taken the time to complete one, especially where there are children or marital issues involved." says Simon Crooks, a solicitor and specialist in tax and estate planning with Argo Life & Legacy Ltd.

"Without a Will you lose the opportunity to express your wishes as to what happens with your assets and who sorts it all out when you die. But a Will encompasses much more than the destination of your assets. You get to choose the people who will manage your affairs on death and they have power to act straight away. If you have younger children you can appoint people as Guardians to be responsible for their upbringing and welfare. One of the key benefits is spending time on yourself and considering surrounding issues - retirement plans, tax planning, care fee planning, policies and pensions. Not having a Will often means none of these issues have been considered which can cause problems in the future. By the time you get to 55 there really is no excuse for not having a Will."

The results also indicate that a vast majority of people do not understand intestacy rules as without a will, if you are separated but not divorced from your spouse they are legally entitled to most, if not all of your estate. Similarly, those who are married and assume that their estate will go to their spouse are technically correct, however without a legal document in place there are numerous complications.

"When a marriage breaks down it is important to review your Will. Separation does not end a marriage and any Will written previously still has effect as do the Intestacy Rules where there is no Will. Under the Intestacy Rules if you are married (or in a civil partnership) and you have no children then your spouse gets your estate - whether you are separated or not. Where children are involved it is more complex as the estate is split between them depending on the value of the assets.

People often think they will review their Will after a divorce is finalised - when they know what their financial position will actually be. But what happens if you die before this is sorted? You're stuck with the Will already in place or the Intestacy Rules and your soon to be former spouse inherits some or all of your estate. It is best practice to write a new Will as soon as you can and review it when the divorce is complete.”

Dying without a Will in place can cause a devastating impact on family and can add new challenges to an already distressing situation, therefore freewillsmonth.org.uk work with charities to offer free will writing services. Throughout March, members of the public age 55 and over are able to have simple wills written or updated free of charge by using participating solicitors.

***

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,524 adults aged 55+. Fieldwork was undertaken between 22nd - 24th February 2017. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 55+).

***

About Safestore Self Storage

Safestore is the UK's largest (and Europe's second largest) provider of self storage solutions. Our principal operations are located in the UK, where we have over 100 stores including two Business Centres with a further 24 stores in Europe. Whether you need self storage for household, business or student purposes, and short term storage, long term storage or seasonal self storage, you'll find exactly what you need with Safestore. More information is available at www.safestore.co.uk.

Contact

Tiffiny Franklin

Marketing Department

marketing@safestore.co.uk

+44 (0)20 8732 1500