65% of SME Businesses Not Ready for Tax Digitalisation

A recent survey by the UK200Group, the UK’s leading membership association of independent chartered accountancy and law firms, showed that 65% of its members’ SME business clients do not currently use software to manage their accounts. They will be forced to adapt significantly in order to use software to comply with HMRC’s ‘Making Tax Digital’ project, which aims to see businesses reporting tax digitally by 2018.

The UK200Group is in a unique position to collect this data, with a nationwide membership of over 150 accountancy and law firm offices, who service a total of around 150,000 SME clients.

The findings of the UK200Group’s survey are as follows:

Bookkeeping method expressed as a percentage of firms surveyed:

Shoebox (16%)

Manual records (23%)

Computer (ie spreadsheets) (27%)

Software (35%)

Of the businesses surveyed by the UK200Group’s members, only 35% already use software, such as Sage, Xero or Cashflow. Although they are not yet reporting tax quarterly – as they will have to do by 2018 – the transition should not be too expensive or time-consuming for these businesses.

A further 27% use computers for their bookkeeping, but will need to change their systems. This may mean retraining staff, but not to the extent of the 23% who are used to manual record-keeping, who will need to train a member of staff to input data into a new software system.

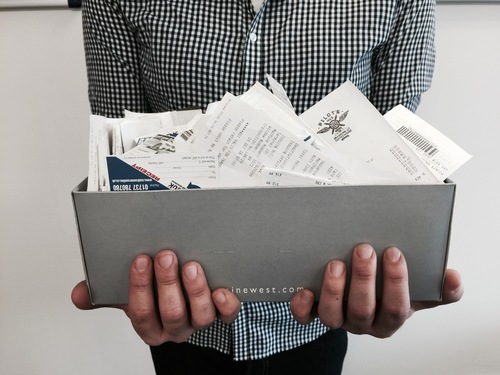

However, the greatest shock will come to the 16% of business owners who use the ‘shoebox method’ – they do nothing to record business transactions and their accountant fills in the detail prior to their tax return each year.

Richard McNeilly, Chair of the UK200Group Digitalisation Taskforce and Managing Partner of Dains, said, “The ‘shoebox method’ users will have to learn how to keep records, invest in software and then spend time inputting the data they collect into the software.

“Making Tax Digital represents the single most significant change to the UK’s system of taxation in recent times, and many of our smaller business clients are simply not ready for it.

“The change to quarterly reporting will require all businesses to change their habits, but over half of the firms we surveyed are also going to have to change the systems they use to record data.

“If HMRC remains committed to having businesses report and pay their tax digitally by 2018, small businesses have only a short period of time to update their systems and many are still unaware that Making Tax Digital is underway.

“That is why the UK200Group has launched the Digitalisation Taskforce. When changing to new systems and processes, the first person most business owners will turn to will be their accountant. As trusted business advisers, we need to be ready to make the transition as easy and painless as possible.”

While there will be a chance for accountants to check their clients’ tax accounts, the new onus on live-time data input will mean that many SME owners will have to learn, or train a member of staff, how to use accounting software to keep HMRC up-to-date.

The UK200Group views Making Tax Digital as the key issue for SMEs in the next few years, and as such has set up a Digitalisation Taskforce to ensure that it can assist business owners with the transition to digital tax accounts and reporting.

The concern is that the new pressures on tax reporting will hit small businesses harder than they hit larger businesses, as smaller firms are less likely to have accounting software and an appointed finance director to oversee it.

In November, the UK200Group issued a recommendation document to HMRC, suggesting changes to the current plan for digitalisation. The conclusion found the following points:

• The timescale for implementation is too short for full consideration and resolution of the issues.

• The principle of Self-Assessment, and the HMRC-taxpayer relationship, will be fundamentally changed.

• HMRC do not seem to understand how accounts are prepared and used by businesses. They seem to regard tax as the primary purpose of accounts, and to seek to alter GAAP for the convenience of HMRC and MTD without regard to the needs of other users of accounts.

• Taxpayers’ appetite to engage with MTD is small, and the proposals seem to offer few benefits to off-set the costs.

• Taxpayers’ ability to engage has been overestimated, and the cost and difficulty of overcoming the obstacles has been understated.

Key recommendations:

Digital Tax Accounts be set up now, providing:

• A central place for a taxpayer to see the information HMRC currently possesses about them.

• A mechanism for providing HMRC with information simply and automatically (reducing the need for phone calls and letters).

• HMRC should consult on the future design of the tax system. Changes in the rights and responsibilities of various parties, and in particular new obligations on taxpayers, should not be introduced until:

o That consultation is complete.

o The necessary technology has been tested over a full compliance cycle (one year of interim reporting plus the end of year procedures).

• Simplifications of accounting should be optional, for tax purposes only.

• Clear benefits for taxpayers should be identified, incorporated, and publicised.

Richard McNeilly concluded, “Businesses using software are almost there, and the only major difference will be quarterly, rather than annual, reporting. Those using Excel spreadsheets will need to upgrade their systems but already have experience of computer input. Even if a business is still keeping manual records, that experience of record-keeping will be transferrable, although digitalisation may cause some pain.

“For any business owner relying on the ‘shoebox method’, our advice is to take the next step and start using software. You are going to have to change your reporting style because by 2018 your accountant won’t be able to accept your paper receipts for a tax return.

“At the UK200Group, we’ve set up the Digitalisation Taskforce to work out how to make the transition as easy as possible for small businesses. We’re going to be here to guide business owners through the whole process of digitalisation.”

ENDS

Media information provided by Famous Publicity. For further information, please contact George Murdoch on 0333 344 2341 or george@famouspublicity.com, Adam Betteridge on 0333 344 2341 or adam@famouspublicity.com or Tina Fotherby on 07703 409 622 or tina@famouspublicity.com.

About the UK200Group:

The UK200Group was formed in 1986, and is the UK’s leading association of independent chartered accountancy and law firms, with connections around the world.

The association brings together around 150 member offices in the UK with more than 500 partners who serve roughly 150,000 business clients. Its international links in nearly 70 countries give its members access to expertise across the globe.