Speciality & Commercial insurers’ “Dark Age Pricing” costing business, poll reveals

53% can’t maximize profitability because of current technology

1 in 5 actuaries ascribe reputational damage to poor pricing models

London, 19 July 2023: Thanks to digitalization, Specialty and Commercial insurers have never had larger risk datasets to analyze. But, a new survey of 350 Specialty and Commercial underwriters and actuaries, conducted by independent research firm Coleman Parkes, for pricing decision intelligence leader, hyperexponential, shows the sector’s archaic pricing and technology fails to realize the value of data to make better pricing and portfolio decisions.

The biggest data issues vary by country. Not having real-time visibility into their portfolios is the leading issue for US respondents, whereas in the UK it’s onerous processes and internal compliance. Insurers’ basic technology fails to quickly and accurately ingest and process large datasets, let alone use that data to generate insights to price risk better.

Current pricing tools don’t deliver

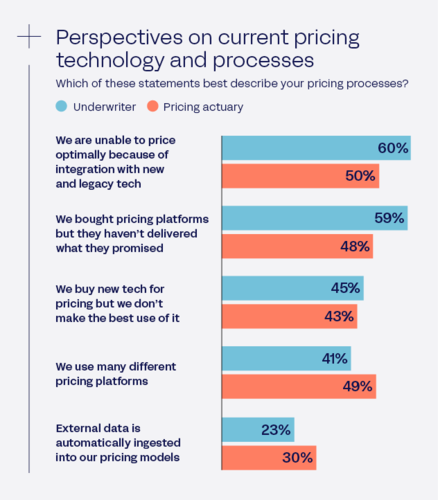

Despite major ongoing investments in technology, neither underwriters or actuaries are happy about the current technology they have in place and 83% believe it needs to be improved. Only 19% of respondents believe their technology allows them to make data-driven decisions.

A large proportion of dissatisfaction with current technology could be down to pricing. More than half, 56%, state their pricing platforms are failing to deliver what was promised, with 45% claiming that although they purchased new pricing technology, they have yet to realize value from it. This is unsurprising when traditional pricing tools act as ‘spreadsheet replacements rather than as a decision engine.

Too much time to waste

Lengthy pricing and underwriting processes, performed on archaic technology, mean highly-trained and highly-paid underwriters and actuaries waste valuable time on admin tasks. On average, underwriters spend three hours each day on data entry. For actuaries, releasing new pricing models takes on average 192 days for US actuaries and 150 days for UK actuaries. The main barrier to underwriting today’s evolving risks, according to respondents, is the risk landscape shifting too rapidly, which is hardly surprising when so much time is wasted on admin tasks.

Pricing is dead, it’s time for pricing decision intelligence

Today, far too many insurers mistakenly think pricing platforms can be used to make better pricing decisions. These tools were built to replace spreadsheets, speeding up the time it takes to build complex pricing models. They were not built to rapidly transform data into insights to drive profitable decisions in the rapidly changing risk landscapes insurers face today. For this, insurers need pricing decision intelligence (PDI), creating an iterative feedback loop between their data, insights and decisions. Only then can insurers leverage their unique, rich, and sometimes unruly pricing data to drive continuous improvement at the speed of the market. Commenting on the industry’s failed approach to pricing, Tom Chamberlain, VP Customer and Consulting at hyperexponential said: “Pricing decisions are the most important lever insurers can pull on profit and loss, but few have been able to achieve meaningful transformation. Today, Specialty and Commercial insurers have the potential to price and assess risk more accurately than ever before using IoT, drones, social media, dash cams, and wearable technology such as smart watches. But they still think pricing is just a one-time number when it is so much more than that. Combined with the right data and technology, pricing insights can be used to make better business decisions. Our research shows a new generation of Specialty and Commercial insurers are painfully aware of these shortfallings and those who can embrace modern pricing technology and processes will win out.”

For more information visit - link to ebook landing page

Ends

Research methodology

Independent research firm Coleman Parkes surveyed 245 underwriters and 105 pricing actuaries across the UK and US working in Specialty and Commercial (re)insurance lines, on behalf of hyperexponential. The aim of the research was to identify the impact legacy technology and processes have on the day-to-day roles of actuaries, underwriters and the overall competitiveness of insurers as well as the changes technology is bringing to their professions over the next five years.

This press release was distributed by ResponseSource Press Release Wire on behalf of Positive Marketing in the following categories: Business & Finance, Computing & Telecoms, Construction & Property, for more information visit https://pressreleasewire.responsesource.com/about.