GBB announces Monzo co-founder as Non-Executive Chair

GBB, which aims to support the build of thousands of new homes, hundreds of new businesses and create dozens of highly skilled new jobs, starting in the North East, while offering an innovative approach to savings, has secured one of the industry’s biggest hitters as its Non-Executive Chair, subject to regulatory approval.

After stepping down from Monzo at the start of the year in a bid to recharge and spend time with his wife Debbie, Paul Rippon has now joined Newcastle-based GBB to lead the Board, ensuring it’s effective, entrepreneurial and transparent.

Rippon co-founded mobile-only bank Monzo in 2015, hitting the headlines when it achieved the fastest ever crowdfunding round in just 96 seconds. Today the bank has over 4m customers and was recently valued at GBP2bn.

After already raising over GBP10m from investors mostly in the North, GBB has made great progress with its banking licence and hopes to receive it before the end of this year.

Upon launch, the bank will offer secured property development loans of between GBP1m and GPB5m, with 90% of lending supporting regional property developers, small and medium sized businesses and construction companies.

For savers, competitive fixed rates with some exciting twists along the way will be protected by the Financial Services Compensation Scheme.

Rippon’s vast experience scales 28 years and roles at eight banks and building societies in the UK and Ireland, including Risk Director, Head of Banking and Deputy Chief Executive. He has worked in PLC, mutual, nationalised, private, charity and venture capital funded institutions. Paul has also served on several boards and sub-committees.

As an entrepreneur with a track record in building businesses and a Fellow of the Chartered Institute of Bankers, Paul’s approach has evolved from being a disruptive change agent, to also one of listener and coach. He is passionate about companies and people being transparent and acting with integrity.

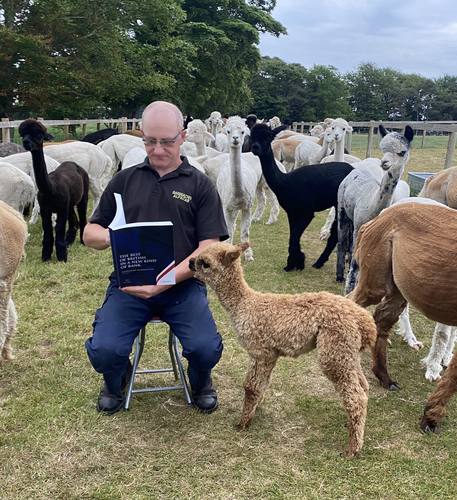

Outside of banking he spends his week helping to run the family business, an alpaca farm called Barnacre Alpacas in Northumberland.

Paul said: “Six months ago I stepped down from Monzo in order to dedicate more time to enjoying life. While I needed time to recharge, I said I intended to come back to banking.

“Around 200 opportunities came my way which was very flattering and I wanted something that would span business, banking and provide a way to help others from more humble beginnings like me.

“Following meetings with the team, I saw and liked the business model which allows GBB to build new homes and businesses and deliver safe and fair savings in a modern and sustainable way. The combination of leading edge technology and relationship managers on the ground to provide support to customers is what property developers are in desperate need of.

“So, in short, the combination of the team and proposition meant that when I was offered the Non-Executive Chair role by GBB, I was humbled and delighted!

“The plan is now to bring my entrepreneurial expertise, storytelling and coaching abilities to bear as we secure the banking licence and build out the bank.”

Steve Deutsch, GBB’s Chief Executive Officer, said: “This is a huge coup for GBB and indeed the North East where we are based. Paul’s expertise is second to none and comes at a critical time as we fundraise and move, upon receipt of our licence, to being fully operational.

“Paul joining us at this point in time is testament to the strength of the offer and wider management team and we’re thrilled to be working with him.”

For more information, please visit www.thegbb.co.uk.

ENDS

About GBB:

GBB is building a new specialist bank that will bring highly skilled jobs to the North East of England, much needed financial support for SME property developers in underserved regions and an exciting savings proposition. For more information, visit www.thegbb.co.uk.

Media contact:

Sarah Waddington at Astute.Work on 07702 162704 / sarah@astute.work

www.astute.work