49% of young mortgage borrowers believe that they will access a better interest rate by paying a mortgage broker fee

Boon Brokers

New independent research conducted on behalf of Boon Brokers, a fee-free mortgage and equity release brokerage, questioned 1,000 mortgage borrowers across the U.K on the topic of mortgage broker fees in the industry.

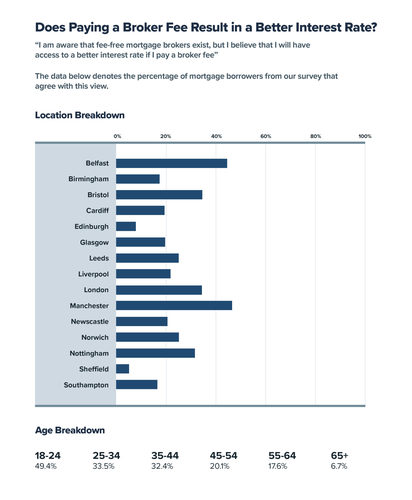

Does Paying a Broker Fee Result in a Better Interest Rate?

Boon Brokers found that almost half (49.4%) of mortgage borrowers between the age of 18 and 24 believe that they will have access to a better interest rate if they pay a broker fee. Just over a third (33.5%) of mortgage borrowers between the ages of 25 and 34 share this belief. The older the borrower, the less likely they are to take this view. Just 6.7% of mortgage borrowers over the age of 65 agree.

The data differs significantly when filtered by the city of the respondent. In England, Manchester has the highest percentage of respondents sharing this view– at 46.3%. This falls to 34.4.% in Bristol, 34.2% in London, 31.4% in Nottingham, 25% in Leeds and 25% in Norwich.

Gerard Boon, Managing Director of Boon Brokers, commented: “These statistics are worrying. Mortgage borrowers need to understand that there is no link between a brokerage’s fee structure and their product access. A fee-free whole-of-market broker is likely to have the same product access as a whole-of-market broker that charges client fees.”.

Will Paying a Mortgage Broker Fee Result in a Better Service?

Almost a fifth of respondents (18.2%) are aware that fee-free mortgage brokers exist but believe they will receive a better service from mortgage brokers that charge a fee.

The younger the borrower, the more likely they are to believe that paying a broker fee will result in a better service. At the extreme ends of the data, this view is shared by 28.6% of mortgage borrowers between ages 18 and 24 compared to just 3.3% of those over the age of 65.

There is a significant difference in the research on the topic depending on the location of the borrower. Glasgow, Belfast and Manchester have the highest percentage of respondents that share this view, at 24.4%, 22.2% and 23.1% respectively, compared to just 9.4% in Bristol and 10% in Sheffield.

Mr. Boon commented “It’s concerning that young people believe that paying a mortgage broker fee will result in a better-quality service. This is likely to be because they have less experience in the market compared to older borrowers. Younger borrowers may believe in the adage that “you get what you pay for”, even though there is no evidence to prove that this is the case in the mortgage broking industry.

Do You Have to Pay a Mortgage Broker Fee?

Boon Brokers found that many mortgage borrowers believe that they must pay a fee to use a broker service.

Over a tenth (14.3%) of mortgage borrowers questioned are unaware that some mortgage brokers do not charge a broker fee. Once again, the data shows that younger mortgage borrowers are more likely to make less informed decisions than older borrowers due to their lack of understanding of the industry. Considering the UK’s cost of living crisis, most mortgage borrowers will be seeking means to cut their expenses to maintain their living standards.

Due to the cost-of-living crisis, 8.6% of respondents confirmed that they would search for a reputable broker with lower broker fees than their current mortgage adviser when they require their service. This plan of action is especially prominent for younger borrowers between the age of 18-24 (15.6%) and 25-34 (13.5%) compared to older age groups. Only 4.4% and 6.2% of respondents between the age of 35-44 and 45-54, respectively, confirmed that they will search for a cheaper mortgage broker due to the cost of living crisis. This indicates that older borrowers are more loyal to their existing mortgage broker than younger borrowers, even if they could switch to a cheaper alternative.

Mr. Boon commented: “With the cost-of-living crisis looming in the U.K, mortgage borrowers need to understand that they do not need to pay mortgage broker fees to access broker services. There are many reputable fee-free, whole-of-market, authorised firms in the market that borrowers can access. Not to diminish the work of brokers that charge client fees, as there are excellent firms in the market that charge, but mortgage borrowers need to understand their options in order to make an informed decision.”

Should Mortgage Brokers Charge Fees?

11.8% of respondents from the Boon Brokers study agree that mortgage brokers should not charge fees to clients because they receive a commission from the lender. The results show that the older the borrower, after the age of 45, the more likely they are to take this view. 20% of respondents over the age of 65 agree.

Boon Brokers found that there was a difference in the level of broker fees charged to each age group. Young borrowers between the age of 18-24 represented the largest age category of borrowers that were charged a client fee of £1,000 or more in the past – at 10.4%. This statistic fell sharply for other age groups:

25-34 – 3.7%

35-44 – 2.2%

45-54 – 2.1%

55-64 – 2.8%

65+ - 1.7%

Mr Boon commented: “It is worrying that young borrowers between the age of 18-24 represent the highest portion of borrowers paying broker fees of £1,000 or more. Asymmetric information is a significant problem in the mortgage sector among young borrowers, as they are the least experienced in the market of any age category. These statistics indicate that intermediaries charging such large fees may be taking advantage of young borrowers’ lack of knowledge and experience of the mortgage process. The FCA’s new Consumer Duty regulation should ensure that all borrowers are treated fairly regarding fees. Hopefully these statistics become more evenly distributed among the age groups in the future.”

ENDS

For further media information please contact: Molly Hatch on digital@boonbrokers.co.uk or 01603 859 007

Notes to editors:

Boon Brokers Limited is an independent mortgage, insurance and equity release brokerage based in East Anglia. Co-founded by Gerard and Michael Boon, the company’s vision is to offer professional advice and arrangement of financial products whilst simultaneously providing the highest quality of advice.

Being independent and directly authorised by the FCA means that advisers can advise and arrange cases on a whole-of-market basis, identifying the most suitable lender/product in the UK to meet a clients’ requirements. The company does not charge any client fees for mortgage or insurance cases. Free consultations are provided nationally.

With over 60 years of experience in the industry, the company is always seeking to innovate with new technology and systems to enhance a clients’ experience.

For more information visit www.boonbrokers.co.uk