- ‘Buy Now Pay Later’ proves a popular way to spread the cost of grabbing a bargain with Gen Z and millennials; cash payments are not yet a thing of the past

UK shoppers are planning to hunt for energy-saving bargains, including blankets and small space heaters, on Black Friday this year. According to new research announced today by quantilope, the research platform that automates advanced research methodologies, more than a quarter (28%) of shoppers plan to buy products to help save on their energy bills this winter, while a third (34%) will look for basic essentials for themselves or their family.

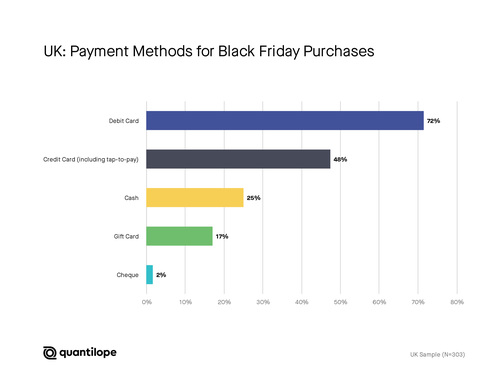

quantilope surveyed 400 consumers in the UK (and 400 in the US) to understand more about their Black Friday shopping habits and how they plan to pay for their purchases. A...