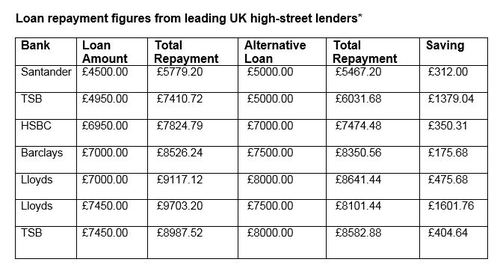

BORROWING £50 MORE FOR A CAR LOAN COULD SAVE YOU UP TO £1600 IN INTEREST CHARGES

● Borrowing more for a car loan could save you money, according to research by What Car?

● In a study of leading high-street lenders, borrowers could save themselves up to £1601 by borrowing just £50 more*

● This trend in repayment savings is evident for loans of up to £8000

● Buyers urged to stay within their means, with UK households borrowing £3.17 billion to purchase new cars in May 2018 alone**

● To see the best deals available on new cars visit What Car? What Car? New Car Buying

Borrowing just £50 more for a new car loan can make it cheaper than taking out a smaller loan according to new research by What Car?, the UK’s leading consumer advice champion.

Analysis of the UK’s leading high street lenders suggests that borrowing the extra amount could save motorists up to £1600 over the course of the repayment period.*

Loans of £5000 typically have lower interest rates than smaller loans. For example, the repayment total of a £5000 loan from TSB over four years comes in around £1300 cheaper than the repayment of a £4950 loan over the same period.

Similarly, at Lloyds the repayment on a £7500 loan over four years is £1601 less than the repayment for borrowing £7450.

What Car? editor Steve Huntingford said: “We would always recommend borrowing as little as possible, but where the loan amount is close to the threshold for a lower interest rate, borrowing as little as £50 extra could save you 10 times that amount, so borrowers should do their homework.”

This trend was most commonly seen when analysing borrowing of amounts between £4500 and £8000.

Research shows that UK motorists are increasingly using finance options to aid with the purchase of cars. Within the first six months of 2018 there was a rise of 8% in car finance lending, with it topping £10 billion.**

However, while taking out a slightly bigger loan can save you money, there is a cut-off point, with loans of more than £8000 costing the borrower more the more they borrow.

Savvy shoppers are able to capitalise on these trends by not only borrowing smartly, but by using the What Car? Target Price on What Car? New Car Buying to ensure they get the best deal.

Car finance top tips:

Shop around – compare the types of finance available and choose the best option available to you

Don’t stretch yourself – only borrow within your means, making sure you can afford the repayments

Additional charges – be aware of additional charges and always read the small print of your loan to be sure you don’t end up with any nasty surprises

ENDS

*Figures come from What Car? research of leading high street banks in the UK, with a maximum saving of £1601.76. Loans and APR rates correct at the time of using online loans calculators provided by high street lenders

**Figures from Finance and Leasing Association

About What Car?

What Car? is the UK’s leading and most trusted car buying brand, online, on video, in social media and in print. It has helped Britain’s car buyers to make purchasing decisions for more than 40 years and its tests are widely regarded as the most trusted source of new car advice.

The all-new whatcar.com marks a pivotal moment in What Car?'s 45 year history of helping Britain's car buyers. The purpose built e-commerce platform connects 20 million potential car buyers to a network of car retailers across the UK.

By combining What Car?'s reputation and heritage with the latest technology, it is now enabling car buyers to communicate with car dealers in a safe, trusted environment. Car buyers can save time, money and hassle by negotiating from the comfort of their armchair, on their own terms and for the first time the New Car Buying platform is integrated seamlessly into our reader's car-buying journey.

The same portal gives dealers efficient, time-saving and cost effective access to customers who are ready to buy a car. It offers a smarter solution for retailers to increase sales and margins through increased lead conversion and ROI.

Every new car deal matches the What Car? Target Price, a discount achieved by our team of mystery shoppers and a fair price for both the consumer and the dealer, enabling every new car buyer to get a great deal local to home.

Through its digital and print channels, What Car? has more than 5.5 million monthly points of contact with its audience on the move, at work, at home and at the crucial point of sale. It is the top performing monthly on the UK newsstand in the motoring category.

For further media information please contact Performance Communications:

Natasha Perry, Andy Bothwell or Sam Wilkinson at Performance Communications on 0208 541 3434.

natasha@performancecomms.com, andyb@performancecomms.com or sam@performancecomms.com