New Benchmark Report by TTi Research Reveals Customer Satisfaction in the Utilities Sector Below UK Average

In this latest cross-industry customer satisfaction benchmarking report, launched in March 2019, new insights from TTi Research mark the UK’s Utilities Sector as a firm ‘Must do better’.

About the Utilities Sector Customer Satisfaction Survey:

The 21-month report provides analysis and exclusive insight into the customer experience energy and water companies provide, including:

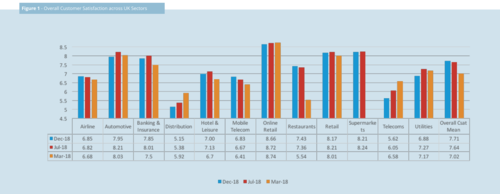

• An overview of Utilities customer satisfaction and how it compares to 11 other sectors, including Retail, Insurance, Banking, Distribution, Telecoms and Airlines. [Fig.1]

• Insight to individual energy and water companies’ performance, including British Gas, SSE, Scottish Power, Anglian Water and more. [Fig.2]

• The Customer Touchpoints that increase Customer Effort

• What customers want from their utility provider

• Factors driving and discouraging employee engagement in the sector

Glyn Luckett, Commercial Director at TTi Research, commented:

“Utility companies face mounting regulatory pressure to deliver a quality customer experience. With both Ofgem and Ofwat moving towards stricter price controls and customer engagement requirements, it has never been more critical for energy networks and water companies to demonstrate to customers they are getting good value for money and great service for the services they buy.”

TTi Research’s UK Customer Satisfaction Benchmark Survey delivers insight into the quality of customer service in Utilities and 11 other industry sectors. Rolling data is derived from an online survey of over 6,000 UK respondents, including 565 utilities customers, conducted over 21 months between 1 May 2017 and December 2018.

Respondents were asked to provide customer satisfaction, customer effort and employee engagement ratings, as well as answer questions about their interactions with different service providers.

The Cost of Leaving Customers Hanging

By measuring customer satisfaction against customer effort across a range of service interactions, the research specialists at TTi Research were able to pinpoint vital customer pain points for companies to prioritise [Fig. 3]. Analysis revealed that, despite increased investment in call centre management systems, utilities customers are still finding service to be below par. Common complaints based on sentiment analysis included:

• Slow to answer calls

• Long hold-times

• Complex phone menus

• Passed around departments and personnel

Focussed research on customer journeys through call centres will provide a robust, comparable measure of what customers expect, whether those expectations are being met and improvements customers want to see, enabling networks to tackle problems at source

Glyn Luckett explained:

“With Utilities’ budgets squeezed, company leaders face difficult decisions on which customer strategies to invest in that will create a positive and distinctive customer experience. Our report shows the value customer research plays in improving decision-making outcomes. By examining the customer journey at each touch point, companies can uncover, not only where gaps in service provision lie, but its importance to the customer, enabling targeted, effective action planning.”

Top of the Class?

Ovo Energy received the highest customer satisfaction score of 9.1/10 – with 10 being the highest - followed by Anglian Water with a score of 8.9. Scottish Power received the lowest customer satisfaction rating with a score of 4.5, followed by Utilita with a score of 6.3.

Winning customer strategies identified among the highest scoring providers include:

• Customer-focussed messaging

• Self-service

• Instilling Trust

• Rewarding brand loyalty

• Promoting Green Energy

• Innovating

For further information about TTi Global’s benchmarking survey, or to find out more about commissioning your own company customer satisfaction research, contact TTi Global.

Download the Survey and Referenced Figures

END