UK200Group’s SME Valuation Index holds strong through tough times

Laura Wiltshire

UK200Group GaPs Admin Assistant

Due to COVID-19, it was touch and go as to whether the UK200Group could gather sufficient deals to produce its annual Small and Medium Enterprises (SME) Valuation Index. However, due to the resilience of our contributing member firms, we are delighted to publish our index as normal in the format of our usual flyer.

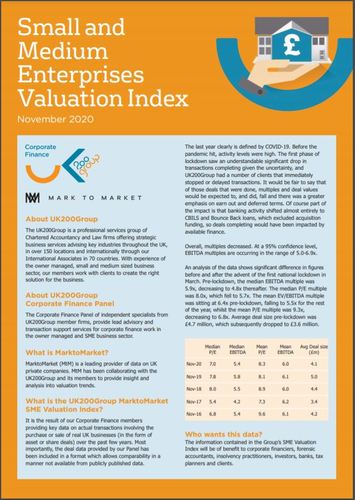

The flyer sets out the not unexpected impact of COVID-19 on SME deal activity and valuations. The first phase of lockdown saw an understandable significant drop in transactions completing given the uncertainty, and UK200Group had a number of clients that immediately stopped or delayed transactions. It would be fair to say that of those deals that were done, multiples and deal values would be expected to, and did, fall and there was a greater emphasis on earn out and deferred terms. Of course, part of the impact is that banking activity shifted almost entirely to CBILS and Bounce Back loans, which excluded acquisition funding, so deals completing would have been impacted by available finance. Overall, multiples decreased. At a 95% confidence level, EBITDA multiples are occurring in the range of 5.0-6.9x. Again, the UK200Group partnered with MarktoMarket, a leading provider of data on UK private companies, to provide insight and analysis into UK200Group valuation trends.

The UK200Group’s SME Valuation Index shows the Median and Mean of the Price to Earnings Ratio (P/E) and EBITDA and the average deal sizes of SMEs to the nearest million. The Index has proved invaluable to SMEs, and to corporate financiers, forensic accountants, insolvency practitioners, investors, banks and tax planners who work with these enterprises.

The UK200Group’s Corporate Finance Panel is made up of individuals from UK200Group member firms, who specialise in corporate finance within their companies. Together, the panel successfully gathers a generous number of deals throughout the organisation to produce this document for public awareness. The data provides key information on actual transactions involving the purchase or sale of UK businesses over this year with data from previous years available. Most importantly, the deal data provided by our Panel has been included in a format which allows comparability in a manner not available from publicly published data.

Speaking about the SME Valuation Index 2020, Simon Blake, Chairman of the UK200Corporate Finance Expert Panel, says:

‘I am delighted to present the latest update of the UK200Group SME Valuation Index, which is widely used for valuation of SME’s for a variety of purposes, including Expert Witness and tax valuations. This year, given the pandemic, we have sought to provide pre and post lockdown multiples. Many thanks to the UK200Group firms providing the data from deals that they have advised on over the past year, and thanks to MarktoMarket for assisting in the collation of the data.’

For more information about MarktoMarket’s product click here to visit their website or Contact Doug Lawson via email: doug@marktomarket.io.

To view the UK200Group SME Valuation Index 2020, please click here.

For more information on UK200Group please visit our website www.uk200group.co.uk or for more information of Expert Panels, please Contact Dee Bates: dbates@uk200group.co.uk or Laura Wiltshire: lwiltshire@uk200group.co.uk or call 01252 350733.

UK200Group Limited is a company registered in England & Wales. Company Number 10634903. Registered office; The Hart Shaw Building, Europa Link, Sheffield, S9 1XU.

Disclaimer

UK200Group is an association of separate and independently owned and managed chartered accountancy firms and lawyer firms. UK200Group does not provide client services and it does not accept responsibility or liability for the acts or omissions of its members. Likewise, the members of UK200Group are separate and independent legal entities, and as such each has no responsibility or liability for the acts or omissions of other members.