The Bank of Grandma and Grandad is Officially Open

Borehamwood, Hertfordshire – March 13, 2017 – Research carried out by Safestore has revealed that 41% of grandparents aged 55 and over would consider leaving the contents of their Will to grandchildren in order to help them financially. The disparity between wages and house prices, the cost of education and fluctuating interest levels from banks puts Generation Y (those born in the 80s and 90s) on the back foot when it comes to secure investments; something the Baby Boomers never had to worry about. Therefore the bank of mum and dad could slowly be replaced by the bank of grandparents.

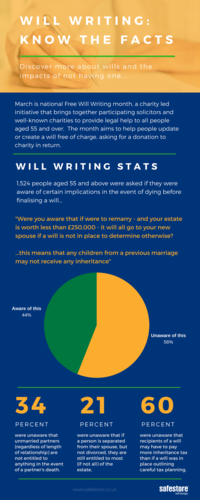

Inspired by Free Will Writing month which takes place throughout March, the self storage company discovered that a number of grandparents would consider skipping a generation when it comes to posthumously distributing their wealth. In total, 26% of all people aged 55 and over said that they would consider leaving their estate to grandchildren:

- 28% said that the most likely reason would be if they felt that their children were financially secure (compared to grandchildren who need more help financially)

- 10% said that even if they were estranged from their children they’d still want their grandchildren to benefit

“These results are interesting as it shows that future planning is changing” says Simon Crooks, a solicitor and specialist in tax and estate planning with Argo Life & Legacy Ltd.

“Generation skipping is a valuable tool in Inheritance Tax planning, which is about getting as much of your assets down to your descendants as you can. Leaving assets to children, especially those who are financially secure and therefore don’t need them, means they are likely to be taxed again before they reach your grandchildren, who are more in need of the funds. Leaving assets to your grandchildren, rather than your children, increasingly makes sense.

With people living longer, by the time there is an inheritance it will be the grandchildren who are in greater need financially. If they have to wait for their parents to leave it to them in turn, the assets will be taxed twice before they reach them. It makes sense to discuss this with your children – not least so it does not come as a surprise to them, but also because they may prefer it if you leave assets to their children rather than themselves. Lots of our clients take this approach and find that discussions with their children make the process a whole lot easier.”

The government would rather you pass assets to your relatives sooner and have introduced changes to Inheritance Tax legislation in recent years. The new Main Residence Relief or Residence Nil Rate Band, which is set to come into effect in April 2017, provides further Inheritance Tax relief for married couples or civil partners - but only if you leave your property to lineal descendants.

However, as more grandparents leave the contents of their will to grandchildren – or are at least willing to consider it – inheritance value is slowly declining. As parents and grandparents are living for longer and require more care later in life, the amount of money people stand to inherit is decreasing year on year.

“We should all be aware of the strain on social and elderly care services. An essential part of Will writing now is to consider planning for care in the future. Having a Will in place alone is not enough. I recommend to all clients, regardless of age, that they put in place Lasting Powers of Attorney to ensure people they choose can manage their affairs should they lose capacity. Without these no one has any authority to act for you except through costly court applications.”

For those unsure of what the future may hold it may be prudent to incorporate Discretionary Trusts into a will as these provide flexibility. Simply put, children and grandchildren are listed as potential beneficiaries and it is up to the trustees as to who benefits, when and how. The key advantage to this is that decisions can be taken at the time rather than second guessing what the position might be at the time of your death.

If the children need the funds they can have them and equally, if they don’t they can pass them on or hold them for the grandchildren. A letter of wishes sits alongside the trust enabling you to put your thoughts down without binding the trustees to any course of action – generally trustees follow these wishes unless there’s good reasons, in consultation with the beneficiaries, not to.

Throughout March, members of the public over the age of 55 are able to have simple Wills written or updated free of charge by using participating solicitors. The organisation, freewillsmonth.org.uk, works with charities to offer free Will writing services to promote the importance of leaving a Last Will and Testament.

***

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,524 adults aged 55+, of which 900 are grandparents. Fieldwork was undertaken between 22nd - 24th February 2017. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 55+).

***

About Safestore Self Storage

Safestore is the UK’s largest (and Europe’s second largest) provider of self storage solutions. Our principal operations are located in the UK, where we have over 100 stores including two Business Centres with a further 24 stores in Europe. Whether you need self storage for household, business or student purposes, and short term storage, long term storage or seasonal self storage, you’ll find exactly what you need with Safestore. More information is available at www.safestore.co.uk.

Contact

Tiffiny Franklin

Marketing Department

marketing@safestore.co.uk

+44 (0)20 8732 1500

This press release was distributed by ResponseSource Press Release Wire on behalf of Safestore Self Storage in the following categories: Women's Interest & Beauty, Personal Finance, Public Sector, Third Sector & Legal, for more information visit https://pressreleasewire.responsesource.com/about.