Crowdfunding and Marketplace Finance Index (CAMFI) launch provides world’s first alternative finance index

CAMFI is a true world first in distilling the overall health of the alternative finance market down into a single number

Partnership between UK’s TAB and China’s BBD and AIF highlights the emergence of alternative finance as a new asset class

24 July - Cambridge-based data intelligence firm TAB has launched the world’s first index into the health of the global online crowdfunding and marketplace finance industry, providing previously unavailable insight.

The new Crowdfunding and Marketplace Finance Index (CAMFI) has been launched in partnership with China-focused big data firm BBD, Hangzhou Ling Hao Technology Co., Ltd. (JZT Data) and academic advisor Academy of Internet Finance in Hangzhou, and aims to become the main financial barometer for the new asset class of alternative finance.

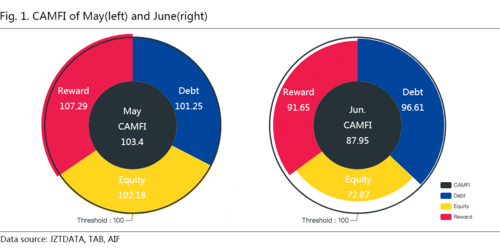

CAMFI analyses more than 4,800 global platforms to estimate the overall monthly climate of the global marketplace finance and crowdfunding industry, weighting the rewards, equity and debt markets, to create a single global metric. The latest CAMFI figures show the industry experienced an overall downward trend in June, with CAMFI dropping from 103.40 in May to 87.95 in June, a decrease of -14.9%.

“CAMFI is a true world first in distilling the overall health of the alternative finance market down into a single number, and will be the single measure by which the world identifies trends and patterns, and assesses the strength of the industry,” said Emily Mackay, CEO, TAB. “With the holiday season beginning it is not unexpected that June would be a lighter month than May, with raises slowing up across the globe and in the northern hemisphere particularly. This also fits with the wider global economic picture, the long-term health of alternative finance is strong and we look forward to quantifying this in CAMFI.”

The index comprise three sub-indices for equity, rewards and debt. The sub-indices show the variation across the industry’s sector in June. The Debt Sub-Index fell from 101.25 in May to 96.61 in June, the Reward Sub-Index moved from 107.29 to 91.65, and the Equity Sub-Index decreased from 102.18 to 72.87 (-28.7%). The change in the Debt Sub-Index is mainly due to the contraction of the global market on the previous month, but the financing efficiency improved.

The size and the financing efficiency of rewards both declined between May and June. Activity in the equity industry reduced markedly from May to June (the index falling from 102.75 to 69.62), which added to the sharp downside of CAMFI in June.

Each month a report will present the index, and analyse the metric across the three dimensions of scale, efficiency and transparency.

Scale: Scale refers to the whole industry’s market volume, which is a principal factor affecting the health of the industry. In June, the scale of trading in the three major sub-sectors (debt, equity and reward) declined to varying degrees, which resulted in a slight decline in the total scale, hovering around 100. Within the three major segments, equity crowdfunding fell by 40% in June.

Efficiency: Efficiency means the average financing rate of the market, i.e. the amount of financing by unit of time; the allocation efficiency of market resource and market information efficiency is also closely related. Compared with May, the financing rate of the debt and rewards sectors fall sharply in June.

Transparency: Transparency refers to the level of information disclosure by the platform. Compared with May, the transparency of the equity and reward sectors in June is at the margin of 100, remaining unchanged from May, with the debt sector showing a slight increase.

“CAMFI means there is now a whole market measure including sub-indices, a powerful tool in trend tracking and informing the global market about this emerging asset class,” continued Emily Mackay, CEO, TAB. “Online finance is a sector that overall is showing considerable growth globally year to year, and CAMFI is a major development in assessing this sector for public bodies, financial analysts, academics, SMEs, corporates and other interested parties.”

Dr. Ben Shenglin, Professor & Dean, Academy of Internet Finance, Zhejiang University and Chairman, Zhejiang Association of Internet Finance, China, added:

“Since its inception in 2005, marketplace finance has grown across the world in volume and variety, and the platforms have developed in various forms and shapes globally due to different market and policy environments. Standardisation is a key opportunity for industry players, investors, regulators and academia. Having an index to capture the overall development of the sector is something desirable but to develop one is an extremely daunting challenge because the availability, integrity and comparability of the data are notoriously poor across various markets. I am pleased that three companies from China (the largest market) and U.K. (the birthplace of the industry) have joined hands to tackle this challenge thanks to their collective strength and wealth of data they have accumulated over the years. Academy of Internet Finance is proud to have served as the academic advisor for this ground-breaking initiative.”

-ends-

About CAMFI

CAMFI is a composite index consisting of the Debt Sub-Index, the Reward Sub-Index and the Equity Sub-Index. To track the health of worldwide crowdfunding platforms, scale, efficiency and transparency of crowdfunding industry were chosen as the primary dimensions, and platform scale, trading scale, user scale, funding efficiency and relationships with industry organisation as secondary dimensions.

Big data is used to conduct quantitative analysis in all dimensions, to build a continuous, innovative and highly representative index system. The index fluctuates around 100. An index score above 100 indicates the increasing health of the industry, and index below 100 indicates that the industry is contracting for the month being measured. The larger the index score, the greater the health improvement. The creation of CAMFI offers a measure of the industry for all stakeholders in the ecosystem, including personal investors and institutional investors, policymakers and governments.

For further information:

PR Contact

Rise PR – PR for TAB

+44 7515 199 487

paul@risepr.co.uk

Notes for Editors

About TAB U.K. Ltd

TAB interprets billions of financial data points from thousands of crowdfunding and P2P platforms globally every day allowing you to identify new opportunities and make better decisions within a disruptive asset class. We cover high growth debt, equity, rewards and other platform types across all geographies. Our service delivers powerful deal-level granularity and micro-to-macro analytics capabilities, with best-in-class data visualisation, personalisation, search and filter functionality built in.

About AIF

Academy of Internet Finance (AIF), Zhejiang University is headquartered in Hangzhou, one of the foremost fintech hubs in China and the world. The first, and broadest, interdisciplinary research institute of its kind in China, AIF boasts the unrivaled connectivity with industry and government authorities. It has served as the founding presidency of Zhejiang Association of Internet Finance, alongside Ant Financial, a global fintech leader. Since its inception in 2015, AIF has taken a global perspective with its academic boards as among the most international of its kind with members hailing from leading institutions in China and abroad. AIF SiNai Lab specializes in research and development of index products across a wide range of sectors, providing valuable insights for industry, government and academia. AIF Marketplace Lending Lab aims to take full advantage of its interdisciplinary nature to focus on the Marketplace lending industry worldwide, and provides fundamental data and decision reference for players, supervisors and consumers.

About Hangzhou Linghao Science and Technology Co. Ltd. (JZTData)

Hangzhou Linghao science and technology co., LTD (JZTData) is a highly innovative FinTech company specialises in providing data and analytics for the future finance industry. Through its cutting edge big data and artificial intelligence technologies, based on accumulated data from more than 6000 P2P Lending, 2000 Banks, and 500 crowdfunding platforms, JZT Data offers comprehensive solutions that helps regulations, researchers and investors to access reliable data, support effective risk management for better investment management as well as improving on regulatory development.

About BBD UK

BBD UK is a leading big data solutions provider, committed to the development of big data technology finance solutions for institutional investors, banks, service providers and policy and regulations department. BBD provides accurate and timely data analysis tools. Focusing on the new economy, through dynamic adjustment to make, credit ratings, risk pricing and economic indicators in four steps, BBD provides large data services from micro to macro.

This press release was distributed by ResponseSource Press Release Wire on behalf of Rise PR in the following categories: Personal Finance, Business & Finance, Computing & Telecoms, for more information visit https://pressreleasewire.responsesource.com/about.