We must change the auditing profession now in order to benefit society

Accounting firms are under constant strain to serve two masters, e.g. serving both clients and the public interest. However according to new research from Nyenrode Business University, auditing is failing to benefit society, and we have to put a system in place in order to challenge the status quo.

According to Assistant Professor of Corporate Governance Remko Renes

“The current system of auditing creates tension between commercial and public interests. Despite all the efforts of accounting firms to improve audit quality in response to the audit inspection reports of regulators, reports from regulators all over the world demonstrate that audit quality must increase substantially.

“We found that there are a variety of reasons why auditors face barriers which stop them acting in the public interest. For example, they want to keep good client relations, they want to be as profitable as possible, or they might not have appropriate staff or a realistic budget.”

In order to combat this Professor Renes and his co-authors from Nyenrode Business University and the University of Central Florida, have a designed an ‘Audit Board.’ The Audit Board focuses on statutory audits of Public Interest Entities (PIEs) which allows legal flexibility per country. The audit fee is objectively defined and based upon an Audit Schedule comprising risks, controls & financial indicators and involves Internal Audit in evaluation of this Audit Schedule. Finally, existing Accounting Firms remain involved in the audit of components and non-mandated audits.

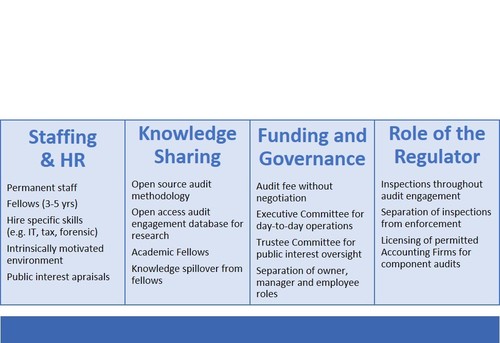

The table to the right, provides an overview of the key characteristics that would improve the current model of auditing.

“The ‘Audit Board’ reduces the problem of institutional commercial pressure. This proposal is based on our critical thinking and insights from 20 stakeholder dialogues with combined with a study of over 100 participants.

“It helps regulators in their efforts to motivate auditors to act in the public interest. It would create an entity that is expert in auditing but avoids many of the independence problems faced by for-profit accounting firms. The innovation can be an alternative for politicians or regulators discussing this subject and can be used on a global scale.” Says Renes

The researchers stress that if auditors could follow this model, they could keep the strength and benefits of the existing model and existing accounting firms, whilst also making sure auditing benefits the rest of society in a more sustainable way.

/ENDS

For more information, a copy of the study or speak to Professor Remko Renes contact Kate Mowbray at BlueSky PR on kate@bluesky-pr.com or call +44 (0)1582 790 711.

This press release was distributed by ResponseSource Press Release Wire on behalf of BlueSky Education in the following categories: Personal Finance, Business & Finance, Education & Human Resources, Public Sector, Third Sector & Legal, for more information visit https://pressreleasewire.responsesource.com/about.