MarktoMarket works with UK200Group to achieve in depth analytics on the SME Valuation Index 2019

Laura Wiltshire

UK200Group GaPs Admin Assistant

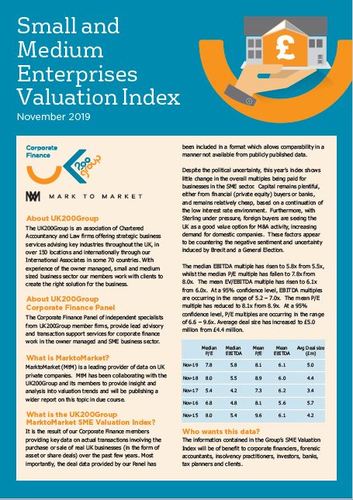

On Thursday 28th November the UK200Group published their latest figures for the Small and Medium Enterprises (SME) Valuation Index. This year’s index shows little change in the overall multiples being paid for businesses in the SME sector. Capital remains plentiful, with an average deal value of £5 million in 2019, either from financial (private equity) buyers or banks, and remains relatively cheap, based on a continuation of the low interest rate environment. Furthermore, with the British sterling under pressure, foreign buyers are seeing the UK as a good value option for Mergers & Acquisitions (M&A) activity, increasing demand for domestic companies.

The UK200Group’s SME Valuation Index shows the Median and Mean of the Price to Earnings Ratio (P/E) and EBITDA and the average deal sizes of SMEs to the nearest million. The Index has proved invaluable to SMEs, and to corporate financiers, forensic accountants, insolvency practitioners, investors, banks and tax planners who work with these enterprises.

The UK200Group’s Corporate Finance Panel is made up of individuals from UK200Group member firms, who specialise in corporate finance within their companies. Together, the panel successfully gathers a generous number of deals throughout the organisation to produce this document for public awareness. The data provides key information on actual transactions involving the purchase or sale of UK businesses over this year with data from previous years available.

This year the UK200Corporate Finance Panel has worked with MarktoMarket, a leading provider of data on UK private companies, to provide insight and analysis into UK200Group valuation trends. Doug Lawson, founder of MarktoMarket, states:

‘We were thrilled to work with UK200Group on the 2019 Index. The UK200Group is a trusted provider of private company valuation insights and we hope that our new collection of sector and size-based indices will be useful to its members.’

Simon Blake, Chairman of the UK200Corporate Finance Expert Panel, states:

‘We have been using the MarktoMarket data platform at Price Bailey for over a year and it quickly became apparent that they are the best positioned data specialist to generate valuable analysis from the collection and aggregation of M&A data from multiple sources.’

For more information about MarktoMarket’s product click here to visit their website or Contact Doug Lawson via email: doug@marktomarket.io.

To view the UK200Group SME Valuation Index 2019, please click here.

For more information on UK200Group please visit our website www.uk200group.co.uk or for more information on Expert Panels, please Contact Dee Bates: dbates@uk200group.co.uk or Laura Wiltshire: lwiltshire@uk200group.co.uk or call 01252 350733.

UK200Group Limited is a company registered in England & Wales. Company Number 10634903. Registered office; The Hart Shaw Building, Europa Link, Sheffield, S9 1XU.

Disclaimer

UK200Group is an association of separate and independently owned and managed chartered accountancy firms and lawyer firms. UK200Group does not provide client services and it does not accept responsibility or liability for the acts or omissions of its members. Likewise, the members of UK200Group are separate and independent legal entities, and as such each has no responsibility or liability for the acts or omissions of other members.

This press release was distributed by ResponseSource Press Release Wire on behalf of UK 200 Group (UK200) in the following categories: Consumer Technology, Personal Finance, Business & Finance, for more information visit https://pressreleasewire.responsesource.com/about.